Debt consolidation: Ideas on how to Negotiate with Lenders

Content

Homeowner’s insurance are practical also; the average The newest Yorker’s homeowner’s advanced is $step one,262 a year. The newest Yorkers have reasonable prices once they have to cover the belongings and you may auto but more costly medical health insurance. The typical rider has a car premium out of $step 1,163 a-year. Ny has just introduced a costs that will help unemployed people that in past times has worked full-day but missing their perform in the pandemic and are now only back to region-go out functions. In the past, jobless is honestly cut in the event you returned to work part-date, but regulations features while the already been changed, therefore specialists do not experience an intense income slashed when they come back to performs.

Are a debt government plan smart?

Because of the properly handling personal debt, somebody and teams can also be boost their economic health, reduce interest costs, and go much time-label financial needs. When thinking about how you would handle your debt, pick the best option for your existing financial predicament. Personal debt management is one way to manage loans, but other options can be worth given. If this sounds like the case to you personally and a creditor seeks to garnish financing in your account, their financial otherwise credit partnership must cover a couple months’ value of the huge benefits and enable you to fool around with those funds.

Next Up In financial trouble Rescue

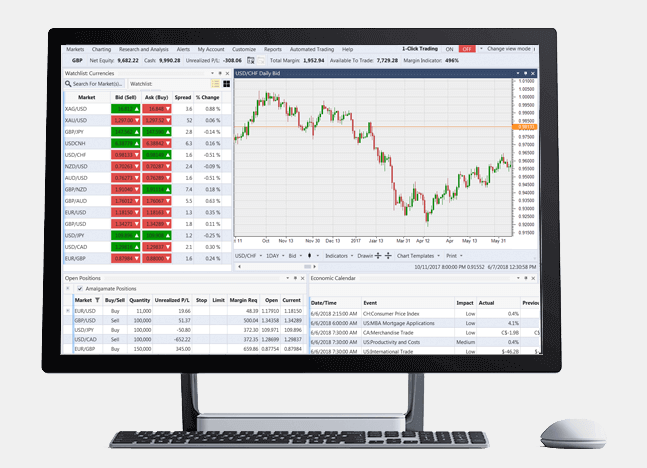

Again, remember that speaking of prices, so you want to keep in touch with a cards therapist for a great free evaluation observe everything’d actually pay before you decide. Loans government software and you will application can assist consumers inside throwing its bills, tracking payments, and you will implementing debt payment actions. These tools might help profiles sit focused on the financial obligation management desires and you can display progress to the as debt-free. Financial financial obligation means financing removed to purchase property otherwise possessions.

To possess Section 13 personal bankruptcy in the Nyc the new projected attorneys fee is $3500 – $7500. All of our pros is right here so you can learn https://zoumou-beauty.com/2024/11/15/cambiar-2000-proair-immediate-connect-el-estado-y-el-sitio-web-actualizado-2024/ the options and you can reach your requirements. When you finish the effortless-to-have fun with on line funds, our authoritative counselors have a tendency to reach out to both you and give advice. Paying off personal debt and you will building wide range are each other key elements of a great economic game plan, however is always to work with getting away from financial obligation first. When you’re totally financial obligation-totally free (apart from your own home loan), you could begin using 15% of one’s earnings to build wide range to have retirement.

When you yourself have more than $600 away from loans forgiven, the brand new canceled loans will be handled because the nonexempt money. Get a free of charge, individualized economic package having actionable actions to eventually strike your finances requirements. Data is sparse, exactly what can be found suggests at least half customers never properly complete the arrangements.

Personal debt government software and debt relief programs is comparable in some respects. They are both made to enable you to get financial obligation-100 percent free, and you can each other help you to get of personal debt with just one down payment per month. Finalized profile could affect the borrowing years, and that steps the average go out you’ve got the account. It may also connect with the credit mix, which procedures the newest numbers and sort of membership you have.

- Balance import notes are generally offered if the credit score are in the a-to-expert range, but may never be offered in case your get is in a straight down diversity.

- That is an important concern that you ought to ask before signing upwards.

- Meaning they’lso are not in the business of fabricating currency of your financial difficulty.

- Municipal securities are debt securities awarded by the local governing bodies to invest in social plans.

- Department away from Justice; one another look after lists out of reliable borrowing counselors.

For individuals who’re searching for financial obligation administration characteristics from DMCC, you can get become because of the contacting otherwise completing a form on the internet. The firm states for the their website you to its debt administration plan can be found “in the most common claims,” nevertheless website directories simply nine—very talk to DMCC to make sure the applying is offered your location. We’ve compared twenty five organizations offering loans government intentions to get some of the best alternatives. To appear on this list, this service membership must be acquireable on the U.S. A good DMP will likely be a solid alternatives if you’d wish to work on a mediator that will help produce a payment plan and you can potentially decrease your rate of interest and you may monthly loans money. The credit guidance team works closely with your creditors to reduce or lose desire and prevent costs.

Bankruptcy proceeding is actually an appropriate process that lets anyone otherwise enterprises so you can launch or reorganize its debts lower than legal supervision. Industrial papers is a short-label, unsecured business loans device generally provided to fulfill quick-term financing requires. Mota terminated Valenti’s subscription for the Aug. 29 and you can told another people one Valenti’s membership are terminated as the he owed money. Valenti emphatically declined the fresh accusations and you can said Mota is retaliating because the of your guarantee category. “The concept that everyone will come with her, win during the market, and take more than without any other debts are a fantasy,” Mota published.

Lower than we will render a short history of a few of the most other preferred credit card debt relief alternatives which can generate much more feel for your current requires. A loans government bundle is just one credit card debt relief solution whenever loans looks daunting, and it also may not be the correct one for your requirements. You happen to be able to do yourself the just what borrowing counselors would do for you within the a debt government package. Such as, you can pick up the phone and have your charge card business regarding the difficulty apps; the brand new bad they might create are say no.

The best loans management company to you is but one that gives a cost bundle that fits your financial budget and you will enables you to achieve your financial desires during the a rate which works for you. When you have a good credit score and require to settle borrowing from the bank credit debt or other non-safeguarded costs, a debt consolidation loan is a superb selection for you. By having good credit, you’ll score a low-interest for a financial loan you to refinances all of your financial obligation with you to definitely monthly payment. This can help you get free from personal debt smaller, and you will wind up investing reduced each month.

That it is the amount of cash you borrowed within the family members on the total amount of credit out there. For example, if you have a charge card which have a limit from $5,100000 and you currently owe $step 1,100, the borrowing from the bank utilization speed on that card would be 20 percent. Most loan providers want to see a credit usage speed out of 29 % or smaller round the their overall rotating membership. Credit guidance inside the Nyc is offered because of the a variety of supply you to vary from firms to people. There are various cons available which promise “credit card debt relief,” and you may need to avoid her or him.

Monetary Planning Processes

A debt administration package (DMP) is a fees schedule which allows you to definitely consolidate expenses for the one to sensible monthly payment and you may reduce the debt through the years, constantly over three to five years. But rather from spending financial institutions myself, the credit guidance agency often assemble and allocate money for every the brand new agreed-up on fee plan. Less than a personal debt government plan, a card specialist will help you to install a sensible plan, discuss best terms along with your financial institutions and you can move the un-secured debts for the one payment per month.

End up being told, however, that will require a great deal of effort, that can score daunting on top of your typical debt. Should you want to work on a new york debt payment business, one of the biggest advantages there’s is the insider education they have off their dependent relationships that have creditors. This will make it simpler to learn whether or not to agree to a deal otherwise if you are capable of actually better. However they will know and therefore loan providers may be difficult to work which have and how to escalate settlement discussions to anyone that have choice-making power. Your debt management program is producing overall performance – you have an idea along with your financial institutions features recognized they.

Registering for a financial obligation management package might have an optimistic impression to your credit ratings over the years. So long as you generate fast costs on the DMP, it shows financial institutions you are making an effort to pay bills, that can improve your credit history. Yet not, signing up for a good DMP get 1st trigger a short-term drop inside the credit ratings. Effective loans management tricks for credit card debt tend to be using a lot more compared to minimum fee, discussing straight down interest levels, and you may consolidating high-interest balance. The debt integration mortgage rate of interest depends upon their borrowing get. Rates for personal finance vary throughout 8 in order to thirty-six per cent, so make certain that the interest rate you receive is leaner than simply the rate you are already using on the a fantastic financial obligation.