Chartered Fund Specialist CFS Definition, Qualifications, & Modules

Therefore, it should always be used in unison with the income statement and balance sheet to get a complete financial overview of the company. The cash flow statement does not replace the income statement as it only focuses on changes in cash. In contrast, the income statement is important as it provides information about the profitability of a company. The cash flow statement is useful when analyzing changes in cash flow from one period to the next as it gives investors an idea of how the company is performing.

Why You Can Trust Finance Strategists

The CFS designation is specific to mutual funds, while the Chartered Financial Analyst (CFA) designation covers a broader range of topics. Certified fund experts must complete 30 hours of continuing education every two years to maintain their certification. It should be noted, cfs finance meaning however, that a CFS is not permitted to purchase or sell mutual funds until they receive the Series 6 license. If a company’s Cash Flow Statement dips in the negative, a company may have to incur loans in order to operate and, in a worst-case scenario, close down.

Certified Fund Specialist (CFS): What They do, Requirements

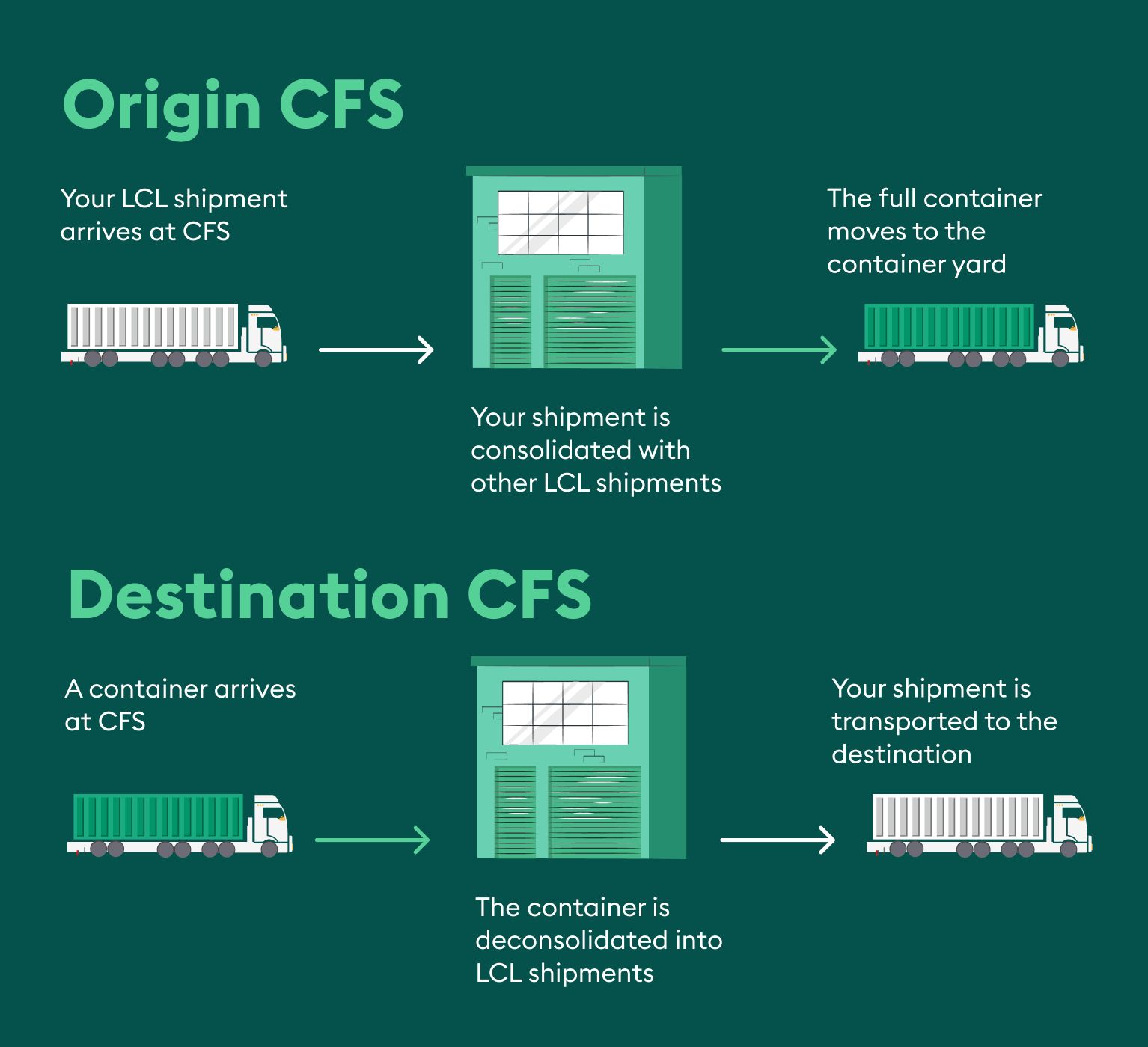

Cash flow statements display the beginning and ending cash balances over a specific time period and points out where the changes came from (i.e operating activities, investing activities, and financing activities). A certified fund specialist (CFS) has received a certification from the Institute of Business & Finance (IBF) for their expertise in mutual funds and the mutual fund industry. Requirements for the designation include passing the certified fund specialist exam. The certified fund specialist exam is one of the oldest certification designations in the mutual fund industry. Investing activities include any sources and uses of cash from a company’s investments.

Cash Flow Statement: Definition

Because of this, many hold Cash Flow Statements in much higher regard than any form of finance-measuring statements such as Earnings per Share statements. Cash Flow brought about by investor activity can be seen substantially reflecting upon the company’s purchases of capital assets. One unique feature of this program is its focus on applying knowledge to real-world scenarios. Students are assigned case studies that require them to analyze different investment options and recommend strategies for clients based on their individual financial goals. This practical approach ensures that CFS graduates are not just knowledgeable professionals but also effective advisors. When cash is used to purchase new machinery, structures, or transient assets like marketable securities, changes in cash from investments are typically seen as cash-out items.

- From 1987 onward, the preparation of the CFS became one of the mandatory statements.

- So, the Cash flow statement helps to analyze the cash flow position of an organization in a given time period.

- The cash flow statement is reported in a straightforward manner, using cash payments and receipts.

- Therefore, certain items must be reevaluated when calculating cash flow from operations.

Step by Step Guide For Preparing Cash Flow Statement

The CFS is a crucial statement since it enables investors to evaluate the company’s financial situation. Additionally, it can be beneficial for helping them make better-informed investing selections. By becoming a Certified Fund Specialist, individuals can enhance their expertise in mutual funds.

The CFS certification requires three proctored, online exams and a case study for completion. A cash flow statement is a valuable measure of strength, profitability and of the long-term future outlook for a company. The CFS can help determine whether a company has enough liquidity or cash to pay its expenses. A company can use a cash flow statement to predict future cash flow, which helps with matters of budgeting.

This team of experts helps Carbon Collective maintain the highest level of accuracy and professionalism possible. It also requires continuing education to maintain, and the IBF offers a range of courses to meet this requirement. This final module looks at the basics of asset allocation, the efficient frontier, optimizing asset allocation, and current portfolio theory.

The total cost includes registration, tuition, textbooks, review questions, practice exams, reference sheets, shipping, the final exams, case study, and a diploma. It focuses on the speed of cash being collected from debtors, stock, and other current assets, as well as the use of cash in paying current liabilities. Like the fund flow statement, this statement also shows the inflow and outflow of cash between two time periods—generally from January to 31 December. For example, the balance sheet simply reports how much cash is held as of a specific date.

Leave a Reply